This report analyzes the latest trends in Wallet Drainer phishing attacks across the EVM ecosystem, providing insights for industry practitioners and users to better protect their assets.

TL;DR

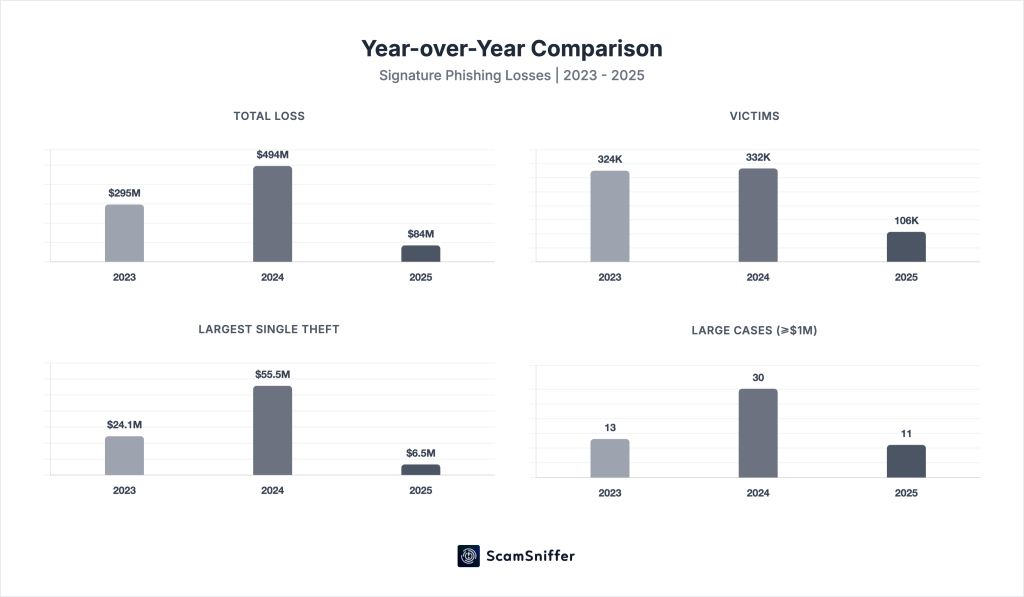

- Total losses: $83.85M across 106,106 victims — down 83% and 68% respectively from 2024

- Largest single theft: $6.5M via Permit signature (September)

- Dominant signature type: Permit remained primary; EIP-7702 malicious signatures emerged after the Pectra upgrade, with 2 large cases in August

Big Picture

2025 saw signature phishing losses plunge from $494M to $83.85M — but the threat didn’t disappear. Losses fluctuated with market cycles.

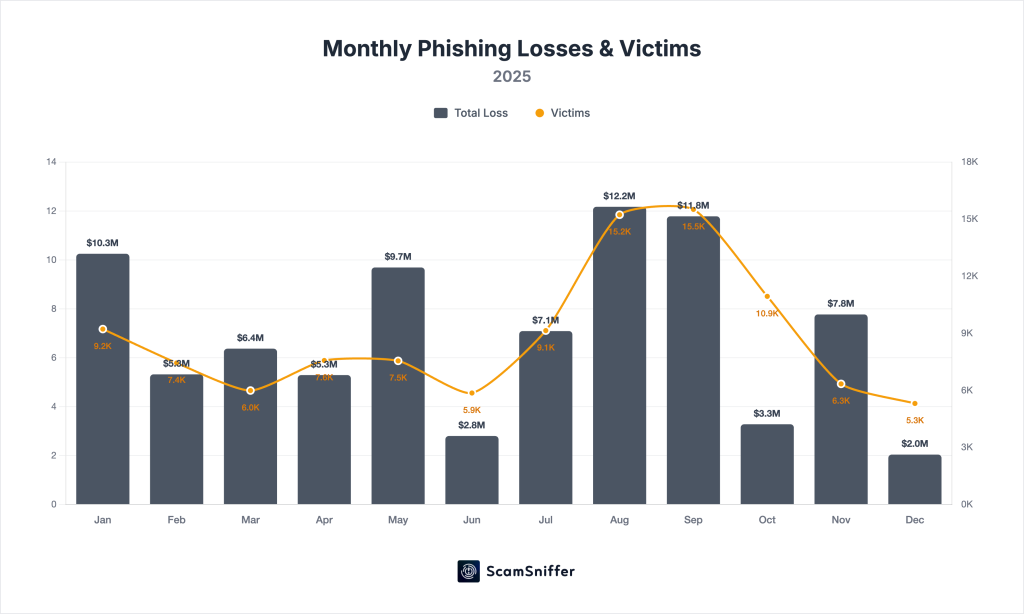

Market correlation: Phishing losses tracked closely with market activity. Q3 saw both the strongest ETH rally and the highest phishing losses ($31M). When markets are active, overall user activity increases, and a percentage fall victim — phishing operates as a probability function of user activity.

- Observed: Monthly losses ranged from $2.04M (December) to $12.17M (August), correlating with market cycles.

- Q3 peak: August-September accounted for 29% of yearly losses during the market’s most active period.

- Q4 decline: As markets cooled, losses fell to $13M — the quietest quarter.

Overview

Definitions

- Wallet Drainer: Phishing infrastructure deployed on malicious websites that induces users to sign harmful transactions, enabling rapid asset extraction.

- Signature Phishing: Attacks that trick victims into signing malicious transactions (approve, permit, setApprovalForAll, etc.) through phishing websites.

Methodology

- Scope: EVM-compatible chains

- Coverage: Wallet drainer attacks via phishing websites only; excludes direct hacks, exchange compromises, smart contract exploits, and other theft vectors

- Valuation: USD value at time of theft

- Limitations: Lower bound estimate; based on trackable drainer activity only; unreported incidents not captured

Key Data Comparison

| Indicator | 2025 | 2024 | 2023 | YoY Change |

|---|---|---|---|---|

| Total Loss | $83.85M | $494M | $295M | -83.0% |

| Victims | 106,106 | 332,000 | 324,000 | -68.0% |

| Largest Single Theft | $6.5M | $55.48M | $24.05M | -88.3% |

| Large Cases (≥$1M) | 11 | 30 | 13 | -63.3% |

Loss Analysis

Monthly Breakdown

| Month | Losses | Victims | MoM Change |

|---|---|---|---|

| Jan | $10.25M | 9,220 | -56% |

| Feb | $5.32M | 7,442 | -48% |

| Mar | $6.37M | 5,992 | +20% |

| Apr | $5.29M | 7,565 | -17% |

| May | $9.69M | 7,547 | +83% |

| Jun | $2.80M | 5,862 | -71% |

| Jul | $7.09M | 9,143 | +153% |

| Aug | $12.17M | 15,230 | +72% |

| Sep | $11.78M | 15,513 | -3% |

| Oct | $3.28M | 10,935 | -72% |

| Nov | $7.77M | 6,344 | +137% |

| Dec | $2.04M | 5,313 | -74% |

Quarterly Summary

| Quarter | Losses | Victims | Avg Loss/Victim | Market |

|---|---|---|---|---|

| Q1 | $21.94M | 22,654 | $969 | Declining |

| Q2 | $17.78M | 20,974 | $848 | Recovering |

| Q3 | $31.04M | 39,886 | $778 | Strong rally |

| Q4 | $13.09M | 22,592 | $580 | Cooling off |

Key Observations

- Market-Loss Correlation: Q3’s highest losses ($31M) coincided with ETH’s strongest rally. More market activity = more potential victims.

- November Anomaly: Losses surged 137% while victims dropped 42%, with average loss per victim rising to $1,225 — a monthly fluctuation rather than a confirmed trend.

- December Cool-off: Lowest month ($2.04M) as market activity declined year-end.

Major Theft Analysis

Cases Exceeding $1M

| Amount | Asset | Date | Signature Type |

|---|---|---|---|

| $6.50M | stETH, aEthWBTC | Sep | Permit |

| $3.13M | WBTC | May | increaseApproval |

| $3.05M | aEthUSDT | Aug | Transfer |

| $1.82M | cUSDCv3 | Mar | Transfer |

| $1.54M | Multiple | Aug | EIP-7702 batch |

| $1.43M | Multiple | Apr | Approve |

| $1.23M | Uniswap V3 NFTs | Jul | setApprovalForAll |

| $1.22M | aPlaUSDT0 | Nov | Permit |

| $1.06M | sUSDf, USDe | Jul | Approve |

| $1.00M | Multiple | Aug | EIP-7702 batch |

| $1.00M | RLB | Jan | Uniswap Permit2 |

Total large-case losses: $22.98M (27% of yearly total)

Signature Type Distribution (from >$1M cases)

| Type | Cases | Total Loss |

|---|---|---|

| Permit / Permit2 | 3 | $8.72M |

| Transfer | 2 | $4.87M |

| Approve / increaseApproval | 3 | $5.62M |

| EIP-7702 batch | 2 | $2.54M |

| setApprovalForAll | 1 | $1.23M |

Attack Trends

- EIP-7702 Exploitation: Emerged shortly after the Pectra upgrade, with attackers leveraging account abstraction to bundle multiple malicious operations into single signatures. August saw the largest cases ($2.54M from 2 incidents).

- Large Cases Concentrated in Q3: 6 of 11 large cases (≥$1M) occurred in July-September, correlating with peak market activity.

- Permit Dominance: Permit/Permit2 signatures accounted for 38% of large-case losses.

Comparison: 2023 → 2024 → 2025

| Aspect | 2023 | 2024 | 2025 |

|---|---|---|---|

| Total Loss | $295M | $494M (+67%) | $83.85M (-83%) |

| Victims | 324K | 332K (+3%) | 106K (-68%) |

| Avg Loss/Victim | $910 | $1,488 | $790 |

| Dominant Signature Type | Permit/Approve | Permit/setOwner | Permit |

| Major Drainers | Inferno, MS, Pink | Inferno, Angel | New drainers emerged |

Beyond Signature Phishing

While this report focuses on wallet drainer attacks, the broader threat landscape includes:

- Bybit Incident (Feb, $1.46B): Lazarus compromised a Safe{Wallet} developer machine, injecting malicious code that spoofed the multisig signing interface — 17x the year’s total signature phishing losses

- Supply Chain Attacks: npm publish credentials stolen via phishing, enabling attackers to inject malicious code into open-source packages; self-replicating worms backdoored hundreds of packages, exfiltrating environment variables and credentials

- Frontend Compromises: Malicious transaction requests injected into legitimate platform interfaces

- Social Media Hijacks: Project X accounts compromised to post phishing links

- Malware & Info Stealers: Fake verification pages, malicious Telegram bots, DPRK IT worker infiltration — targeting private keys and credentials

Outlook

Lower losses ≠ gone threats.

- If markets are active, phishing activity may rise with them — wallet security integration and user education remain critical defenses.

- The decline in trackable losses may partly reflect a shift toward harder-to-track attack vectors — private key compromises and targeted social engineering are not captured in drainer statistics.

- The threat landscape is bifurcating: mass phishing for retail users vs. sophisticated supply chain/APT attacks for high-value targets.

- The drainer ecosystem remains active — as old drainers exit, new ones emerge to fill the gap.

The numbers change. The threat persists. Stay vigilant.

Scam Sniffer Research | December 2025